LevelFields AI

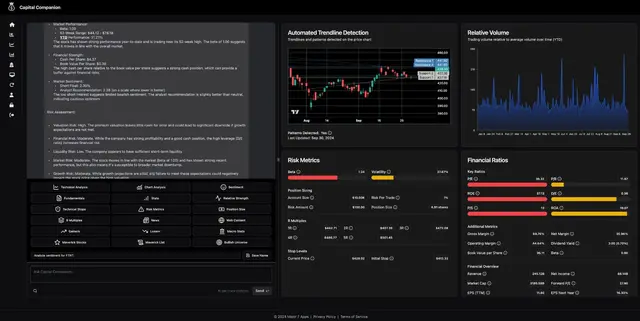

What is LevelFields AI?

LevelFields AI is a stock trading platform that uses artificial intelligence to analyze market events and identify potential trading opportunities. The platform scans events across 6,300 companies, focusing on catalysts like product launches, leadership changes, and lawsuits that could impact stock prices.

Top Features:

- Event Pattern Analysis: identifies historical patterns to predict stock price movements based on similar events.

- Automated Alert System: delivers customized trading opportunities directly to your inbox based on profit goals.

- Research Automation: reduces analysis time from hours to seconds by filtering meaningful market events.

Pros and Cons

Pros:

- Time Efficiency: cuts through market noise by focusing on events that actually impact stock prices.

- Data-Driven Decisions: removes emotional bias from trading by relying on historical event patterns.

- Comprehensive Coverage: monitors 6,300 companies for potential trading opportunities across markets.

Cons:

- Learning Curve: requires time investment to understand and utilize all platform features effectively.

- Annual Commitment: subscription model requires upfront annual payment rather than monthly options.

- Capital Requirements: users need significant trading capital to implement suggested strategies.

Use Cases:

- Event-Based Trading: capitalizing on market movements triggered by corporate announcements and changes.

- Long-term Investment: identifying entry points for extended positions based on event catalysts.

- Options Trading: executing strategic options plays based on anticipated market movements.

Who Can Use LevelFields AI?

- Active traders: individuals seeking data-driven trading opportunities in stock and options markets.

- Technical analysts: traders looking to complement technical analysis with event-based insights.

- Investment researchers: professionals needing quick access to market-moving corporate events.

Pricing:

- Level 1 Plan: self-directed access to scenarios, data, and customizable alerts.

- Level 2 Plan: includes analyst guidance, personal training, and SMS trade alerts.

Our Review Rating Score:

- Functionality and Features: 4.5/5

- User Experience (UX): 4.0/5

- Performance and Reliability: 4.2/5

- Scalability and Integration: 3.8/5

- Security and Privacy: 4.3/5

- Cost-Effectiveness and Pricing Structure: 3.5/5

- Customer Support and Community: 4.0/5

- Innovation and Future Proofing: 4.4/5

- Data Management and Portability: 4.1/5

- Customization and Flexibility: 4.2/5

- Overall Rating: 4.1/5

Final Verdict:

LevelFields AI stands out with its event-driven approach to trading, making it valuable for data-focused traders. While the annual commitment might deter some, the platform's AI-powered insights and comprehensive market coverage make it a worthy investment for serious traders.

FAQs:

1) How accurate are LevelFields AI's trading signals?

The platform analyzes historical patterns and filters out 95% of non-impactful news, focusing only on events with proven market impact potential.

2) What's the minimum investment needed to start?

While there's no set minimum, users should have adequate trading capital to implement the strategies effectively, especially for options trading.

3) Can I switch between Level 1 and Level 2 plans?

Upgrading from Level 1 to Level 2 is possible with remaining subscription credit applied, but downgrades are rarely permitted.

4) How many trade ideas does Level 2 provide?

Level 2 members typically receive 1-2 new trade ideas per week, including entry and exit price targets.

5) Is the platform suitable for beginners?

Beginners are recommended to start with Level 2 for personalized training and guidance, though it requires higher initial investment.

Stay Ahead of the AI Curve

Join 76,000 subscribers mastering AI tools. Don’t miss out!

- Bookmark your favorite AI tools and keep track of top AI tools.

- Unblock premium AI tips and get AI Mastery's secrects for free.

- Receive a weekly AI newsletter with news, trending tools, and tutorials.