GiniMachine

What is GiniMachine?

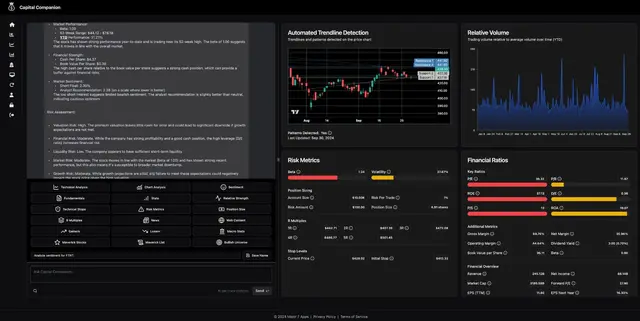

GiniMachine is a no-code AI decision-making platform that transforms historical data into predictive models. The platform processes terabytes of data to build and deploy scoring models in minutes, making it valuable for credit scoring, debt collection, and risk management.

Top Features:

- Automated Model Building: creates predictive models from historical data in under 10 minutes.

- Risk Assessment: analyzes borrower profiles and predicts loan repayment probability.

- Collection Strategy: prioritizes debtors and suggests effective collection methods.

Pros and Cons

Pros:

- Speed: builds and validates models within minutes instead of days.

- Accessibility: no coding or data science expertise required.

- Versatility: handles both structured and unstructured data effectively.

Cons:

- Data Requirements: needs minimum 1000 historical records for accurate predictions.

- Learning Curve: initial setup and data preparation can be challenging.

- Integration: may require technical support for complex system integrations.

Use Cases:

- Credit Assessment: evaluates loan applications using alternative data sources.

- Debt Recovery: optimizes collection efforts through predictive scoring.

- Customer Analysis: predicts churn rates and identifies upsell opportunities.

Who Can Use GiniMachine?

- Financial Institutions: banks and alternative lenders seeking automated credit decisions.

- Collection Agencies: companies looking to optimize debt recovery processes.

- Risk Managers: professionals needing data-driven risk assessment tools.

Pricing:

- Free Trial: 21-day trial available with full feature access.

- Pricing Plan: starts from €100 per month, custom enterprise plans available.

Our Review Rating Score:

- Functionality and Features: 4.5/5

- User Experience (UX): 4.2/5

- Performance and Reliability: 4.3/5

- Scalability and Integration: 4.0/5

- Security and Privacy: 4.4/5

- Cost-Effectiveness: 4.1/5

- Customer Support: 4.2/5

- Innovation: 4.3/5

- Data Management: 4.4/5

- Customization: 4.2/5

- Overall Rating: 4.3/5

Final Verdict:

GiniMachine stands out as a powerful AI decision-making tool that delivers quick, accurate results. While it requires substantial historical data, its ability to process complex information and provide actionable insights makes it an excellent choice for financial institutions and collection agencies.

FAQs:

1) How much historical data is needed to start using GiniMachine?

A minimum of 1,000 records with known outcomes is required for building reliable predictive models.

2) Can GiniMachine integrate with existing systems?

Yes, it can integrate through API connections and supports both cloud and on-premise deployment options.

3) Is technical expertise required to use GiniMachine?

No, its no-code interface allows non-technical users to build and deploy models without programming knowledge.

4) How long does it take to build a predictive model?

With prepared data, model building typically takes 2-10 minutes, depending on data complexity.

5) What types of data can GiniMachine process?

It processes both structured and unstructured data, including financial records, behavioral data, and alternative data sources.

Stay Ahead of the AI Curve

Join 76,000 subscribers mastering AI tools. Don’t miss out!

- Bookmark your favorite AI tools and keep track of top AI tools.

- Unblock premium AI tips and get AI Mastery's secrects for free.

- Receive a weekly AI newsletter with news, trending tools, and tutorials.