Greip

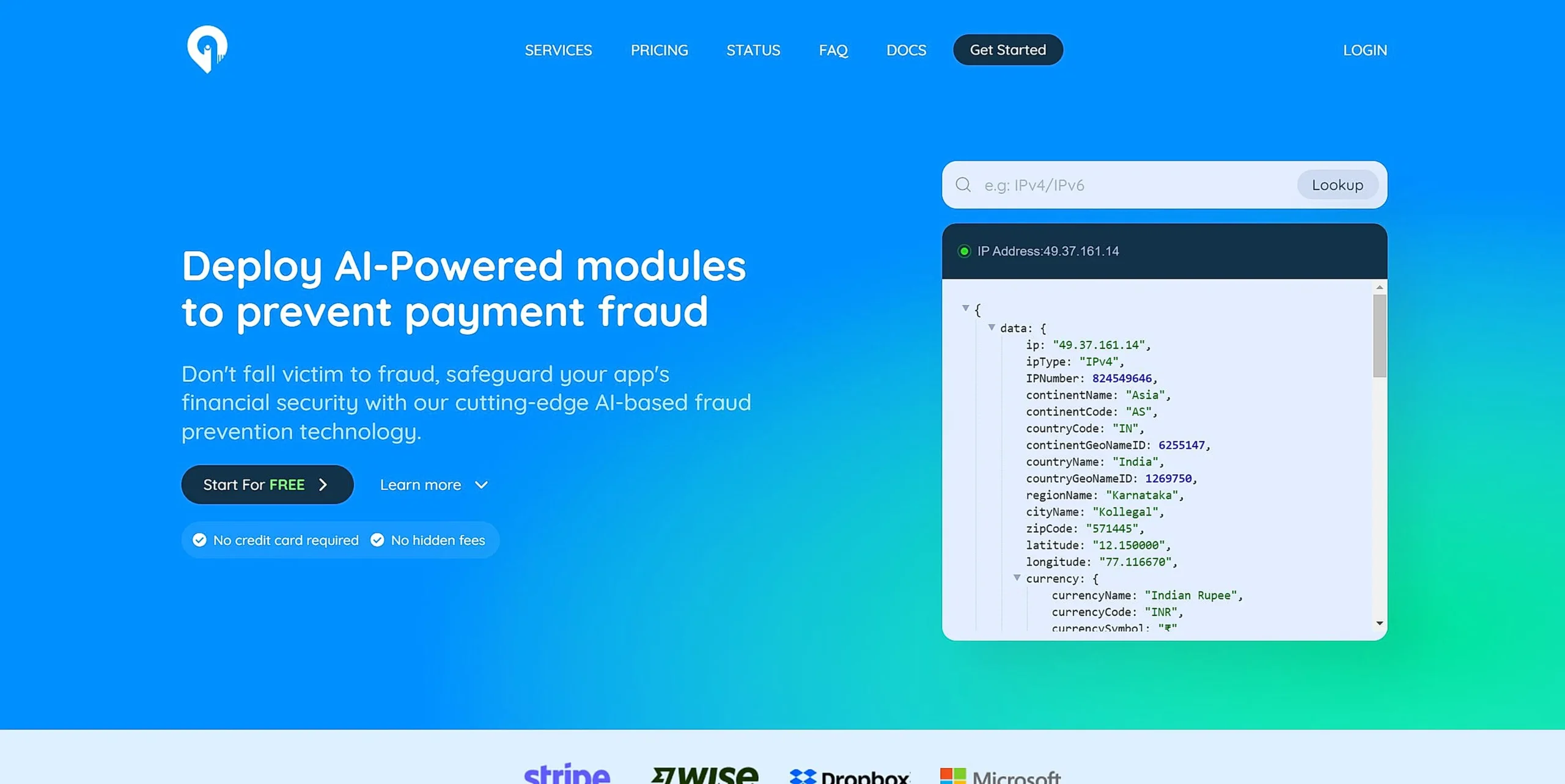

What is Greip?

Greip is an AI-powered fraud prevention platform that protects applications and websites from payment fraud and identity theft. The platform combines advanced machine learning algorithms with real-time monitoring to create a secure environment for online transactions.

Top Features:

- IP Geolocation: detailed tracking of user locations including continent, country, region, and city data.

- VPN/Proxy Detection: identifies potentially malicious users attempting to mask their true location.

- Payment Fraud Prevention: validates credit card information and monitors suspicious transaction patterns.

Pros and Cons

Pros:

- Comprehensive Protection: multiple fraud detection modules working together to secure your platform.

- Real-time Monitoring: instant alerts and insights through an intuitive dashboard interface.

- Flexible Integration: supports multiple programming languages and platforms with simple implementation.

Cons:

- Pricing Structure: monthly costs may be high for small businesses with limited budgets.

- Request Limits: strict monthly request caps on lower-tier plans require careful usage monitoring.

- Learning Curve: initial setup and configuration may require technical expertise.

Use Cases:

- E-commerce Security: protecting online stores from fraudulent transactions and chargebacks.

- User Verification: validating user identities and preventing account fraud.

- Content Moderation: filtering inappropriate content and maintaining platform safety.

Who Can Use Greip?

- Online Businesses: companies conducting financial transactions through their platforms.

- Application Developers: teams building secure web and mobile applications.

- Financial Services: organizations requiring advanced fraud prevention measures.

Pricing:

- Free Plan: 15,000 monthly requests with basic features.

- Standard Plan: $14.99/month for 170,000 requests and additional features.

- Premium Plan: $29.99/month for 400,000 requests and complete feature access.

- Enterprise Plan: custom pricing for unlimited requests and premium support.

Our Review Rating Score:

- Functionality and Features: 4.5/5

- User Experience (UX): 4.2/5

- Performance and Reliability: 4.3/5

- Scalability and Integration: 4.4/5

- Security and Privacy: 4.7/5

- Cost-Effectiveness: 4.0/5

- Customer Support: 4.1/5

- Innovation: 4.3/5

- Data Management: 4.2/5

- Customization: 4.1/5

- Overall Rating: 4.3/5

Final Verdict:

Greip stands out as a reliable fraud prevention solution with powerful AI capabilities. While pricing may challenge smaller businesses, its comprehensive security features and flexible integration options make it a valuable investment for organizations prioritizing fraud protection.

FAQs:

1) How does Greip detect VPN and proxy connections?

Greip uses AI algorithms to analyze IP addresses and network patterns, identifying characteristics typical of VPN and proxy services.

2) Can Greip integrate with existing payment systems?

Yes, Greip provides APIs and SDKs for multiple programming languages, allowing smooth integration with various payment platforms.

3) What types of fraud can Greip prevent?

Greip prevents payment fraud, identity theft, account takeover, and suspicious transactions through its multi-layered detection system.

4) Is Greip suitable for small businesses?

Yes, with its free tier and scalable plans, small businesses can start with basic protection and upgrade as they grow.

5) How accurate is Greip's fraud detection?

Greip's AI-powered system maintains high accuracy rates through continuous learning and real-time pattern analysis.

Stay Ahead of the AI Curve

Join 76,000 subscribers mastering AI tools. Don’t miss out!

- Bookmark your favorite AI tools and keep track of top AI tools.

- Unblock premium AI tips and get AI Mastery's secrects for free.

- Receive a weekly AI newsletter with news, trending tools, and tutorials.