Jiffy.ai

What is Jiffy.ai?

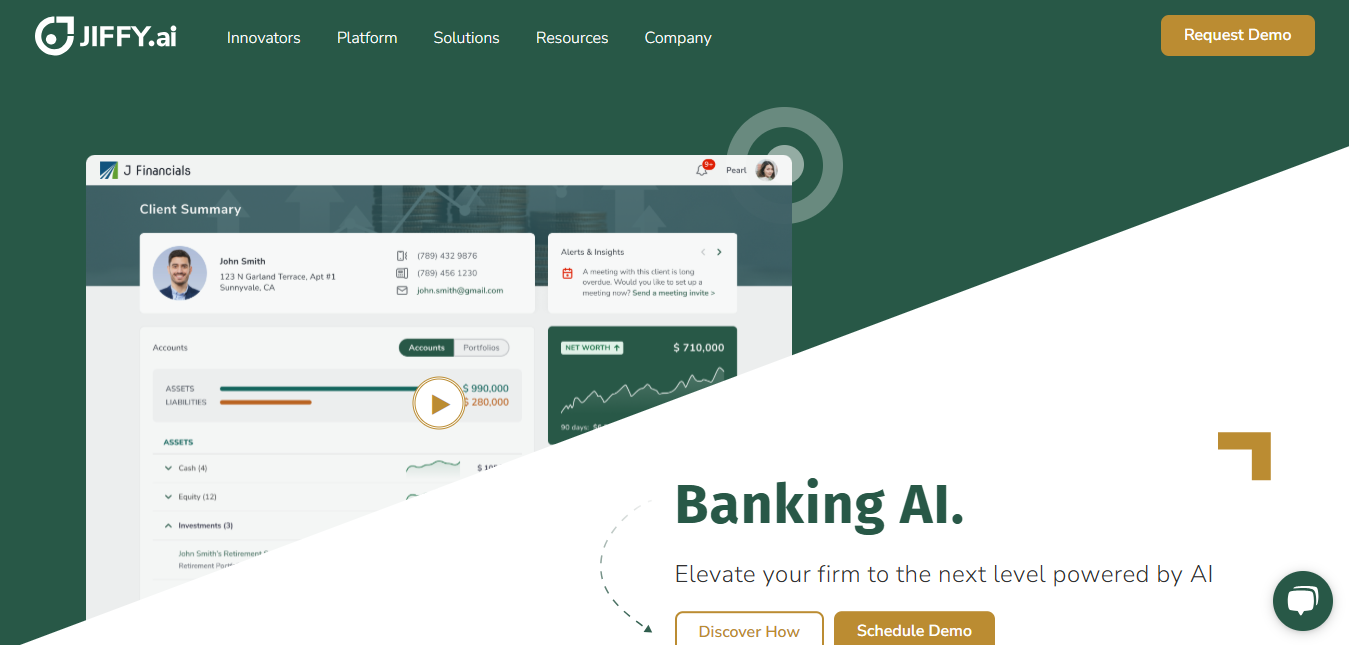

Jiffy.ai is a no-code automation platform that combines AI capabilities to transform business operations. The platform specializes in automating financial services workflows, from customer onboarding to account servicing, helping organizations reduce manual tasks and accelerate digital transformation.

Top Features:

- AI-Powered Automation: intelligent system that streamlines complex workflows and eliminates repetitive manual tasks.

- No-Code Platform: allows quick development of applications without technical expertise.

- Real-Time Monitoring: provides comprehensive dashboard for tracking business metrics and customer interactions.

Pros and Cons

Pros:

- Time Efficiency: reduces manual processing time by automating customer data management and notifications.

- Multi-Channel Integration: connects various communication channels for unified customer experience.

- Quick Implementation: delivers solutions 10x faster than traditional development methods.

Cons:

- Learning Curve: initial setup may require time to understand platform capabilities.

- Complex Pricing: pricing structure isn't transparent and varies based on implementation needs.

- Limited Customization: some features may not fit specific business requirements perfectly.

Use Cases:

- Financial Services: automating customer onboarding and account management processes.

- Wealth Management: streamlining advisor onboarding and investor relationship management.

- Banking Operations: managing consumer service requests across multiple channels.

Who Can Use Jiffy.ai?

- Financial institutions: banks and credit unions looking to modernize operations.

- Wealth management firms: companies seeking to improve advisor and client experiences.

- Professional services: organizations aiming to automate employee onboarding processes.

Pricing:

- Custom Solutions: pricing based on specific business requirements and implementation scope.

- Enterprise Plans: tailored packages for large-scale deployments.

Our Review Rating Score:

- Functionality and Features: 4.5/5

- User Experience (UX): 4.2/5

- Performance and Reliability: 4.3/5

- Scalability and Integration: 4.4/5

- Security and Privacy: 4.5/5

- Cost-Effectiveness and Pricing Structure: 3.8/5

- Customer Support and Community: 4.0/5

- Innovation and Future Proofing: 4.4/5

- Data Management and Portability: 4.2/5

- Customization and Flexibility: 4.0/5

- Overall Rating: 4.2/5

Final Verdict:

Jiffy.ai stands out in financial services automation with its AI capabilities and no-code approach. While pricing transparency could improve, the platform delivers significant value through faster implementation and reduced manual workload.

FAQs:

1) How does Jiffy.ai differ from traditional automation tools?

It combines no-code development with AI capabilities, specifically designed for financial services automation needs.

2) What kind of support is available during implementation?

The platform provides dedicated implementation support and ongoing technical assistance for enterprise clients.

3) Can Jiffy.ai integrate with existing banking systems?

Yes, it's designed to integrate with core banking applications and legacy systems.

4) How long does it take to implement Jiffy.ai?

Implementation time varies but is typically 10x faster than traditional development methods.

5) Is Jiffy.ai suitable for small financial institutions?

While primarily targeted at larger institutions, solutions can be scaled for smaller organizations.

Stay Ahead of the AI Curve

Join 76,000 subscribers mastering AI tools. Don’t miss out!

- Bookmark your favorite AI tools and keep track of top AI tools.

- Unblock premium AI tips and get AI Mastery's secrects for free.

- Receive a weekly AI newsletter with news, trending tools, and tutorials.