Monarch money

What is Monarch Money?

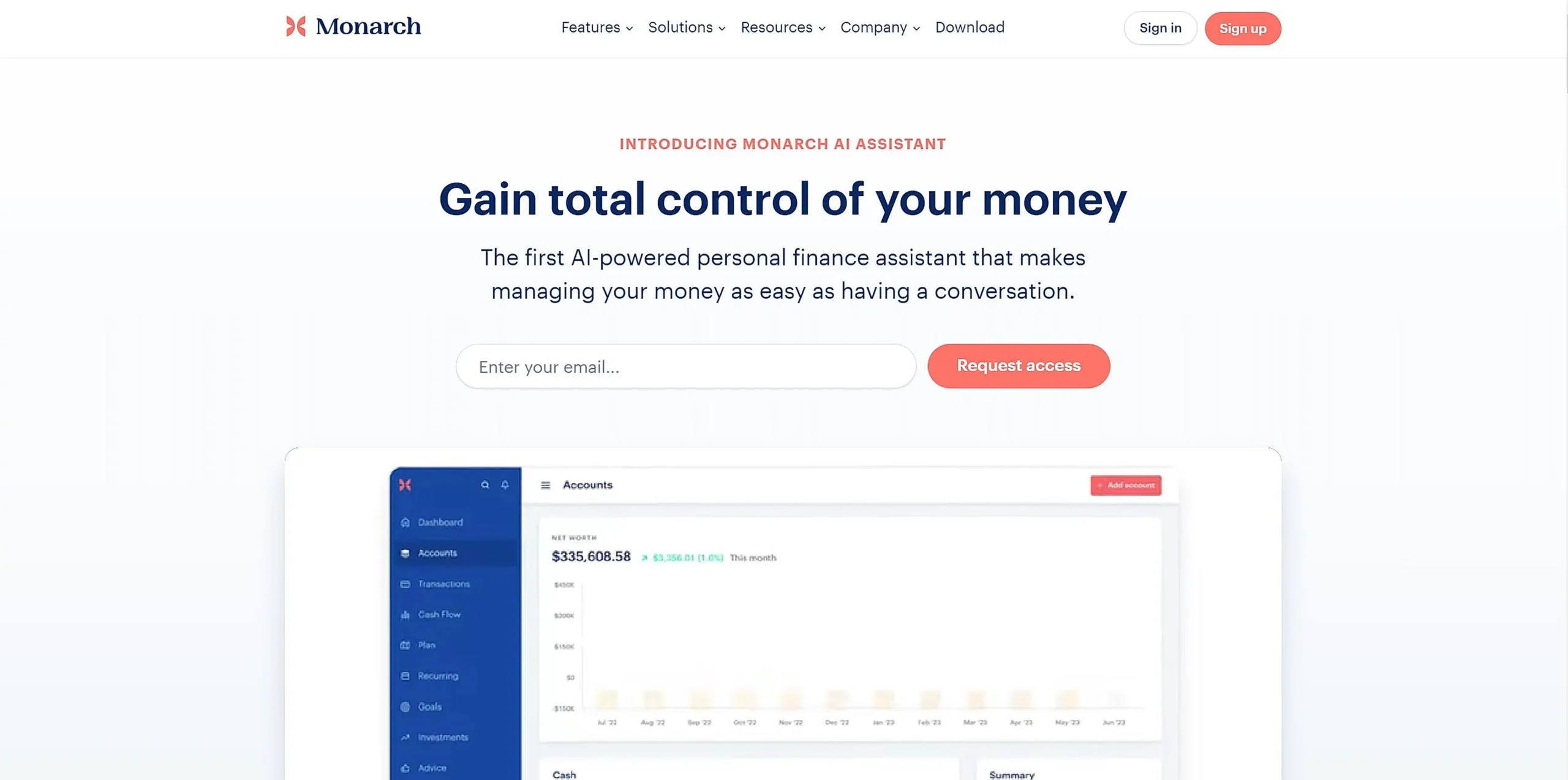

Monarch Money is a comprehensive personal finance management platform that combines budgeting, investment tracking, and goal setting in one interface. This modern money management tool helps users visualize spending patterns, track net worth, and collaborate with family members on financial planning.

Top Features:

- Smart Transaction Management: AI-powered categorization that learns and adapts to your spending patterns.

- Customizable Dashboard: personalized financial overview with charts and widgets for quick insights.

- Multi-Account Sync: connects with over 13,000 financial institutions for complete money tracking.

Pros and Cons

Pros:

- Advanced Integration: syncs with multiple financial data aggregators for reliable account connections.

- Collaborative Features: free additional user accounts for family members and financial advisors.

- Clean Interface: ad-free experience with intuitive navigation and visual data representation.

Cons:

- Cost Barrier: no free version available, subscription required for all features.

- Limited Crypto Support: only integrates with Coinbase, leaving out other crypto platforms.

- Customer Service: support limited to email and help center requests.

Use Cases:

- Budget Planning: creating and maintaining zero-based budgets with rollover options.

- Investment Monitoring: tracking portfolio performance and asset allocation in real-time.

- Family Finance: managing household expenses and shared financial goals together.

Who Can Use Monarch Money?

- Budget-Conscious individuals: people wanting detailed control over their spending and savings.

- Couples and families: households needing to coordinate their financial management.

- Investment trackers: individuals monitoring multiple investment accounts and portfolio performance.

Pricing:

- Free Trial: 30-day trial period to test all features.

- Premium Plan: $99.99/year or $9.99/month, with occasional promotional discounts.

Our Review Rating Score:

- Functionality and Features: 4.5/5

- User Experience (UX): 4.8/5

- Performance and Reliability: 4.3/5

- Scalability and Integration: 4.7/5

- Security and Privacy: 4.6/5

- Cost-Effectiveness and Pricing Structure: 3.8/5

- Customer Support and Community: 3.5/5

- Innovation and Future Proofing: 4.2/5

- Data Management and Portability: 4.4/5

- Customization and Flexibility: 4.6/5

- Overall Rating: 4.3/5

Final Verdict:

Monarch Money stands out with its powerful budgeting tools and clean interface. Despite the premium price point, it delivers exceptional value through comprehensive financial tracking, family sharing, and sophisticated visualization tools. Perfect for dedicated budgeters seeking detailed financial control.

FAQs:

1) Is Monarch Money worth the subscription cost?

Yes, if you value ad-free experience, family sharing, and comprehensive financial tracking. The cost is justified by its extensive features and regular updates.

2) Can I import data from other budgeting apps?

Yes, Monarch Money supports CSV imports from various platforms, including Mint, making the transition smooth.

3) How secure is Monarch Money?

It uses bank-level encryption and read-only access to your accounts. Your login credentials are never stored on their servers.

4) Does Monarch Money work internationally?

While it primarily focuses on U.S. financial institutions, it can connect to some international banks and manual account creation is available.

5) What happens if my accounts disconnect?

Monarch Money will notify you of connection issues and provides tools to reconnect accounts or manually update transactions.

Stay Ahead of the AI Curve

Join 76,000 subscribers mastering AI tools. Don’t miss out!

- Bookmark your favorite AI tools and keep track of top AI tools.

- Unblock premium AI tips and get AI Mastery's secrects for free.

- Receive a weekly AI newsletter with news, trending tools, and tutorials.