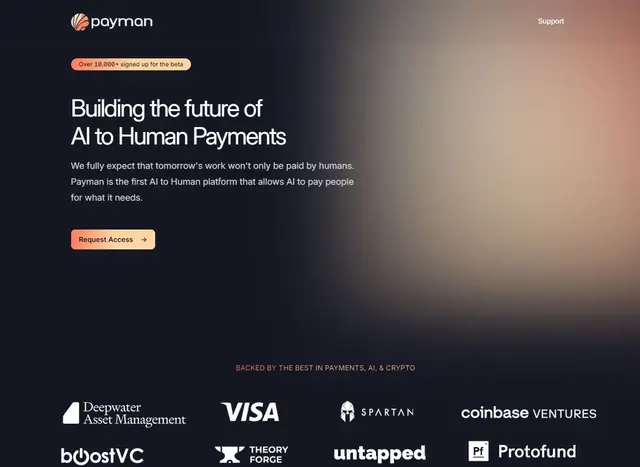

PaymanAI

What is PaymanAI?

PaymanAI is a financial infrastructure platform that enables AI agents to handle monetary transactions with built-in safety measures. The platform creates a secure bridge between AI capabilities and financial operations while maintaining human oversight and control.

Top Features:

- Separate Financial Accounts: dedicated AI accounts with predictive funding keep main accounts protected.

- Smart Payee Protection: limits transactions to pre-approved payees for maximum security.

- Human-in-Loop Controls: customizable approval workflows ensure human oversight of all AI transactions.

Pros and Cons

Pros:

- Security: multiple layers of protection keep primary accounts isolated from AI operations.

- Control: comprehensive dashboard for monitoring and managing AI spending activities.

- Compliance: built-in fraud prevention and enterprise-grade security measures.

Cons:

- Limited Autonomy: approval requirements might slow down some automated processes.

- Integration Complexity: may require technical expertise to implement effectively.

- Learning Curve: teams need time to understand and configure all security features.

Use Cases:

- Automated Purchasing: AI agents managing routine procurement with controlled spending limits.

- Financial Operations: automated payment processing with human verification checkpoints.

- Treasury Management: AI-assisted fund allocation with protected primary accounts.

Who Can Use PaymanAI?

- Tech Companies: businesses implementing AI solutions for financial operations.

- Financial Institutions: banks and fintech companies automating payment processes.

- Enterprise Organizations: large companies seeking secure AI payment infrastructure.

Pricing:

- Custom Pricing: contact required for tailored solutions based on business needs.

- Enterprise Plans: specialized pricing for large-scale implementations.

Our Review Rating Score:

- Functionality and Features: 4.5/5

- User Experience (UX): 4.0/5

- Performance and Reliability: 4.5/5

- Scalability and Integration: 4.0/5

- Security and Privacy: 5.0/5

- Cost-Effectiveness and Pricing Structure: 3.5/5

- Customer Support and Community: 4.0/5

- Innovation and Future Proofing: 4.5/5

- Data Management and Portability: 4.0/5

- Customization and Flexibility: 4.0/5

- Overall Rating: 4.2/5

Final Verdict:

PaymanAI strikes an ideal balance between AI automation and security in financial operations. While the platform requires initial setup effort, its robust security features and controlled automation make it a solid choice for businesses ready to modernize their payment systems.

FAQs:

1) How does PaymanAI protect against unauthorized transactions?

PaymanAI uses separate financial accounts, pre-approved payee lists, and mandatory human approval workflows to prevent unauthorized spending.

2) Can PaymanAI integrate with existing banking systems?

Yes, PaymanAI partners with Stripe Payments Company and Fifth Third Bank for secure integration with existing financial systems.

3) What types of transactions can AI agents perform through PaymanAI?

AI agents can perform any pre-approved payment operations within set limits and to authorized payees only.

4) Is human oversight mandatory for all transactions?

Yes, PaymanAI requires human approval through customizable workflows before completing transactions.

5) How does PaymanAI handle compliance and regulation?

The platform includes enterprise-grade compliance controls, transaction monitoring, and fraud prevention systems built into its core infrastructure.

Stay Ahead of the AI Curve

Join 76,000 subscribers mastering AI tools. Don’t miss out!

- Bookmark your favorite AI tools and keep track of top AI tools.

- Unblock premium AI tips and get AI Mastery's secrects for free.

- Receive a weekly AI newsletter with news, trending tools, and tutorials.