Taxly

What is Taxly?

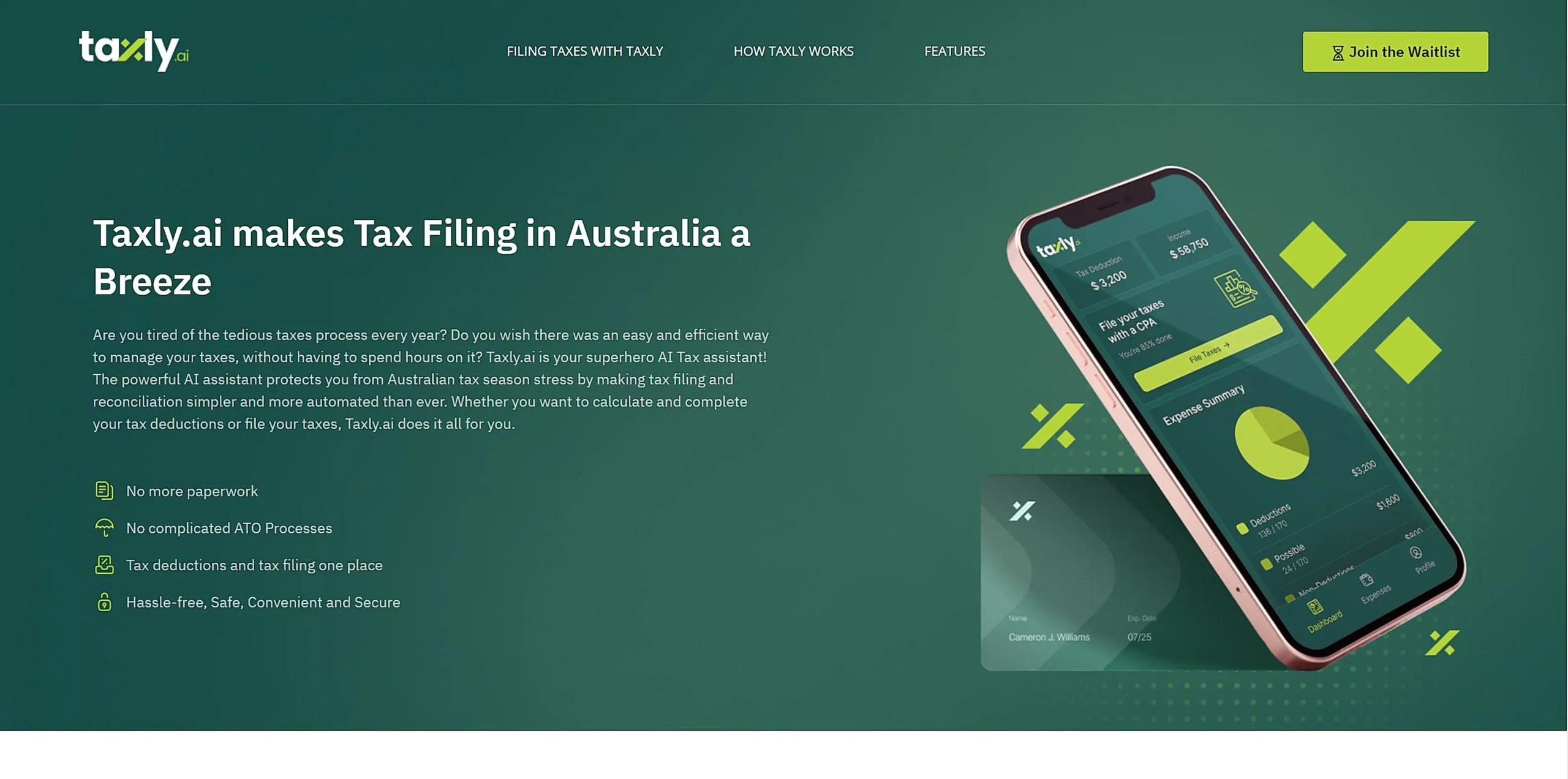

Taxly is an AI-powered tax assistant designed for Australian freelancers, contractors, and self-employed professionals. The platform uses artificial intelligence to scan transactions, identify deductions, and automate tax filing processes while providing expert CPA support.

Top Features:

- AI Transaction Scanning: automatically identifies and categorizes eligible tax deductions from financial records.

- CPA Expert Support: provides access to certified Australian tax professionals for personalized guidance.

- Real-time Tax Calculator: estimates quarterly tax obligations based on current transactions and deductions.

Pros and Cons

Pros:

- Time Efficiency: reduces tax preparation time through automated transaction scanning and categorization.

- Accuracy: minimizes human error with AI-powered deduction identification and calculation.

- Professional Support: combines AI automation with human expertise for optimal results.

Cons:

- Limited Availability: currently only available in Australia.

- New Platform: may need more user feedback and testing to prove reliability.

- Learning Curve: initial setup and integration might take time for less tech-savvy users.

Use Cases:

- Tax Deduction Management: helps freelancers track and maximize their eligible tax deductions.

- Quarterly Tax Planning: assists contractors in estimating and preparing quarterly tax payments.

- Financial Record Keeping: maintains organized digital records of all tax-related transactions.

Who Can Use Taxly?

- Freelancers: independent professionals managing multiple income streams and deductions.

- Contractors: skilled workers needing efficient tax management solutions.

- Self-employed Individuals: business owners looking to streamline their tax processes.

Pricing:

- Free Trial: available for testing core features.

- Pricing Plan: quote-based pricing tailored to individual needs.

Our Review Rating Score:

- Functionality and Features: 4.5/5

- User Experience (UX): 4/5

- Performance and Reliability: 4/5

- Scalability and Integration: 3.5/5

- Security and Privacy: 4.5/5

- Cost-Effectiveness: 4/5

- Customer Support: 4.5/5

- Innovation: 4.5/5

- Data Management: 4/5

- Customization: 3.5/5

- Overall Rating: 4.2/5

Final Verdict:

Taxly stands out as an effective AI tax assistant for Australian self-employed professionals. While the platform is new, its combination of automated features and expert CPA support makes it a practical choice for simplified tax management.

FAQs:

1) How does Taxly protect user data?

The platform uses bank-level encryption and security protocols to protect all financial and personal information.

2) Can Taxly integrate with existing accounting software?

Yes, it integrates with various accounting platforms through API connections.

3) What type of CPA support is included?

Users get 24/7 access to certified Australian CPAs for tax-related questions and guidance.

4) How accurate is the AI deduction identification?

The AI system claims 98% accuracy in identifying eligible deductions, with CPA verification available.

5) Is Taxly suitable for complex tax situations?

Yes, it handles various tax scenarios while providing expert CPA support for complex cases.

Stay Ahead of the AI Curve

Join 76,000 subscribers mastering AI tools. Don’t miss out!

- Bookmark your favorite AI tools and keep track of top AI tools.

- Unblock premium AI tips and get AI Mastery's secrects for free.

- Receive a weekly AI newsletter with news, trending tools, and tutorials.